How can AI play a role in mitigating the cost impact of the new SEC rules changes on the Private Equity Industry?

September 28, 2023

The new rules released in August by the US Securities and Exchange Commission have received widespread coverage and have shocked many veterans of the Private Equity Industry. Leading commentators have acknowledged that this new move by the SEC increases the administrative and compliance burden, which is already significant, and may drive further cost increases. At a time when managing side letters and compliance obligations are already a challenge for fund managers, what are the options to use AI to mitigate some of the risks and to alleviate the compliance and administrative burden?

New SEC rules changes

The purpose of the SEC's new rules is to drive transparency within the industry, with private funds required to give investors regular statements (on a quarterly basis) that provide information about performance, expenses and fees. Whilst there are already a lot of private fund managers that provide detail and oversight about the fund activities, the new rules will require much more in-depth detail, placing more onerous obligations and requirements on fund managers.

There has already been an appeal lodged in a Texas court at the beginning of September by a group of Private Equity Funds and Industry Trade Groups on the basis that this new regulation will raise the administrative costs and make it much harder for the private funds industry to attract and secure investment.

The Chief Executive of Robin AI, Richard Robinson wrote in the FT Adviser on Thursday 28th September 2023 about the rise of the compliance burden for private funds. He notes in the article that, "perhaps the most contentious and fought over aspect of the regulations relate to providing investors with preferential treatment. The use of side letters to secure special rights for individual investors outside of the LPA, which applies to all a fund's investors, has been growing in prevalence in recent years."

Managing side letters

In a previous blog post, the team at Robin AI discussed how cumbersome side letter management has become in the private equity industry, with a huge increase in the number of side letters used, and the length of the side letter documents. We discussed research by Elisabeth de Fontenay and Yaron Nili which detailed that the average word count of side letters has risen from 639 prior to 2005, and stood at a huge 4,983 words post 2014.

This increase means that side letters have gone from single page documents, to now 8 page or more documents, placing a huge burden on fund mangers. From increased administrative costs, to increase spend on external legal counsel, side letters have created a number of challenges. The process to manage side letters has historically been very manual and administrative in nature, with funds creating large excel spreadsheets listing out the different investors, commitment amounts, special terms, and obligations. It is often external legal counsel that prepare these spreadsheets, which need to be manually updated to include the correct information.

Adopting tech-forward approaches

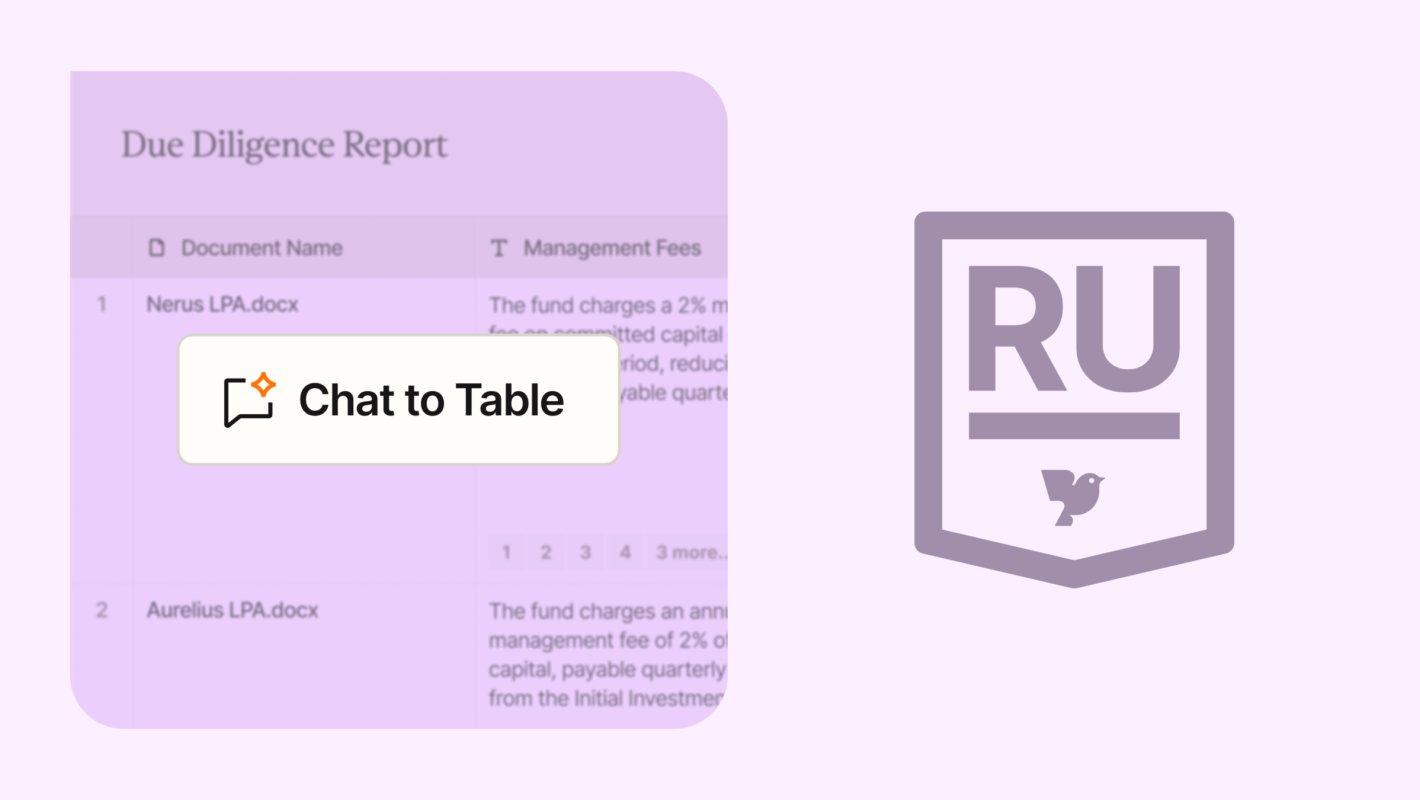

Software has played a critical role in helping private funds to better manage their compliance and administrative costs. Developments in AI have also increased the opportunity to use technology to do business critical tasks, like finding very specific information across large data sets. The team at Robin AI have developed easy-to-use tools that enable fund managers, legal professionals, investor relations teams and others to quickly surface information buried in side letters, and to be able to compare key provisions and clauses, without needing to resort to tracking in spreadsheets. One of the most recent developments has been natural language querying, which enables fund managers to ask questions like "can I invest in a microbrewery" and the AI will retrieve the relevant clauses buried in side letters that relate to investment restrictions concerning alcohol. Having this information readily accessible reduces spend on external counsel, reduces administrative costs, and enables GPs to build better relationships with the LPs in a competitive market landscape.

A recent new feature at Robin AI called Obligations Management has further supported teams in the private markets space by enabling teams to assign responsibilities and tasks, ensuring that deadlines are not missed. This has enabled teams to save hundreds of hours, and ensured compliance with reporting requirements - something that will only increase in significance as a result of the SEC rules changes.

There is a wealth of new technology solutions that harness the power of large language models that enable private funds to better manage their costs and administrative tasks. In a climate of increasing scrutiny and reporting obligations, technology can do the heavy lifting when it comes to keeping on top of responsibilities across teams. Robin AI has been used be PE funds across 4 continents to betters manage side letters, to save time and money on compliance, and to reduce the administrative burden on teams.